Fire EMS & Police & Vineyard Property Tax

- Julie Fullmer

- Aug 5, 2024

- 14 min read

Updated: Aug 6, 2024

A critical need requiring urgent attention in Vineyard is public safety staffing.

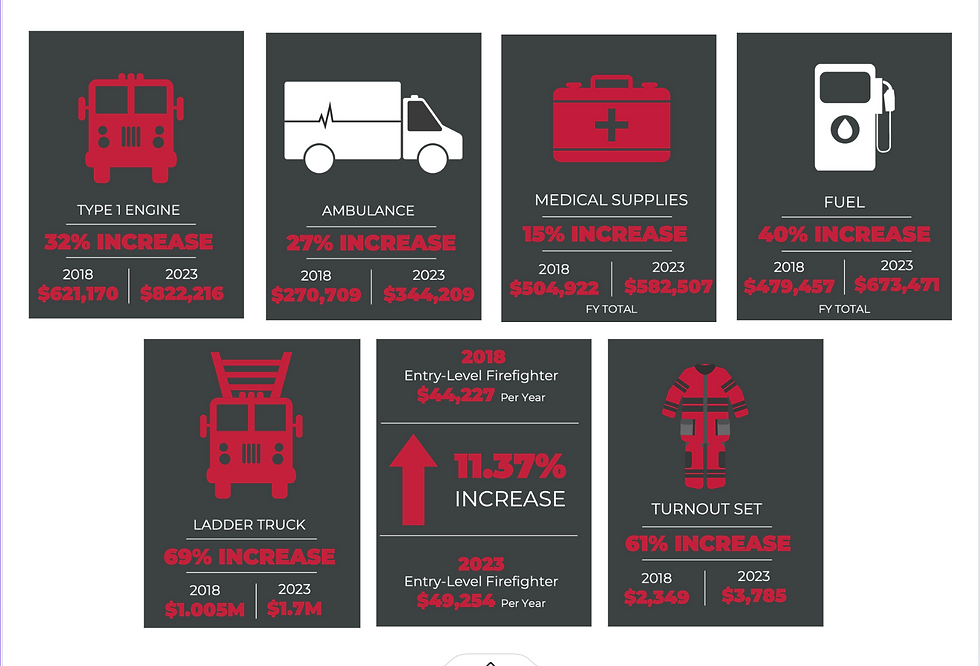

Despite our city's exceptional services, current fire response times average 6.5 minutes, compared to the national standard of 4-5 minutes. Our comprehensive fire study, ArcGIS engineering data, and new fire standards have revealed the need for increased staffing at the new firehouse. Similar discussions are underway in neighboring cities, such as Lindon.

To address this, a new firehouse, budgeted for and designed in 2023 and approved in 2024, is under construction on the west side of the Utah Transit Authority and Union Pacific train tracks in Vineyard.

This facility aims to improve emergency response times and service reliability. The city has allocated funds this year to staff an initial team of six members at the new firehouse.

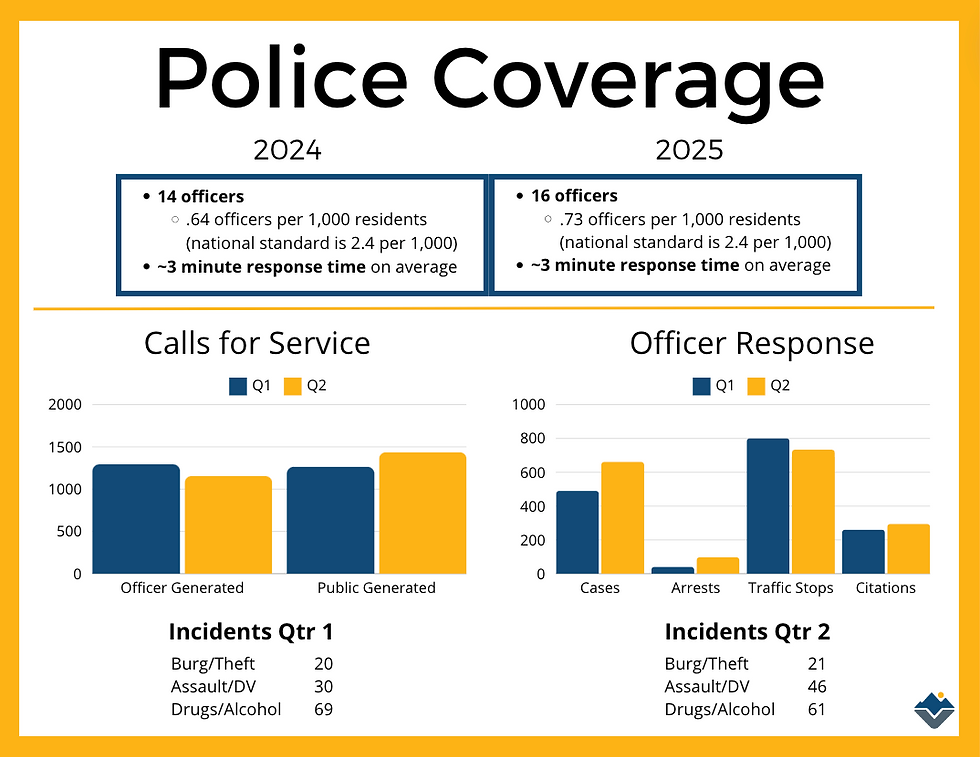

As Vineyard continues to grow, our Police Force is expanding to maintain comprehensive coverage and safety. The Utah County Sheriff’s Vineyard Division will add two new positions to ensure robust community protection.

To support these needed advancements in public safety, an increase in property tax is necessary. This would mark the city's first tax rate adjustment since 2002. 100% of the property tax collected goes towards funding public safety, however, even after the increase proposed, our Property Tax only covers 71% of two basic services.

In 2023 property taxes covered around 83% of public safety, without the 2024 tax rate adjustment, that coverage will move to 59%. The adjustment will bring that percentage to 71%.

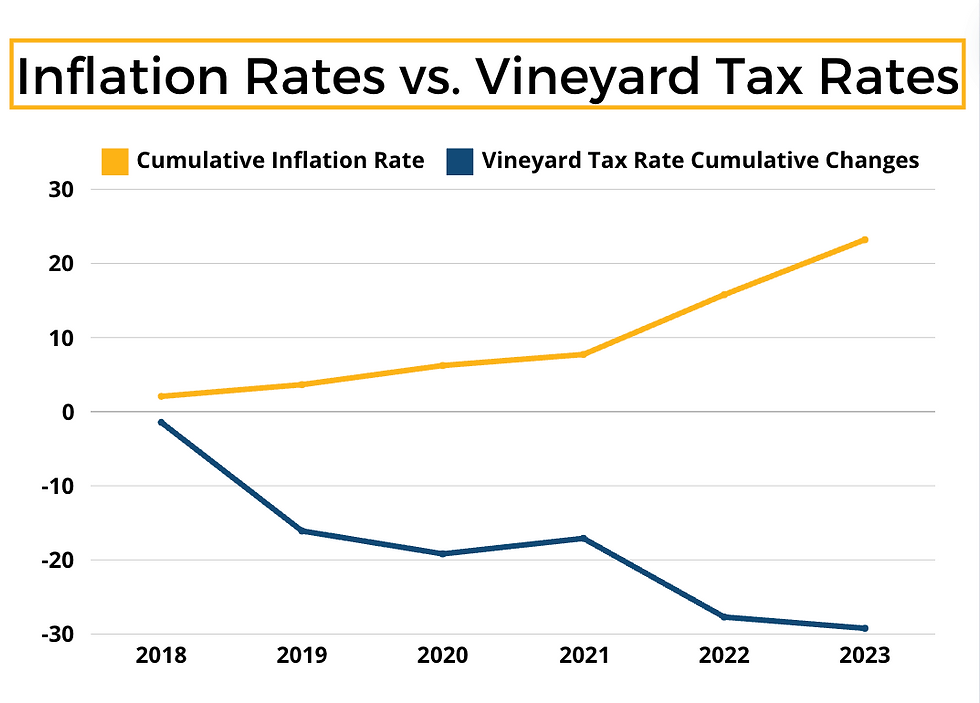

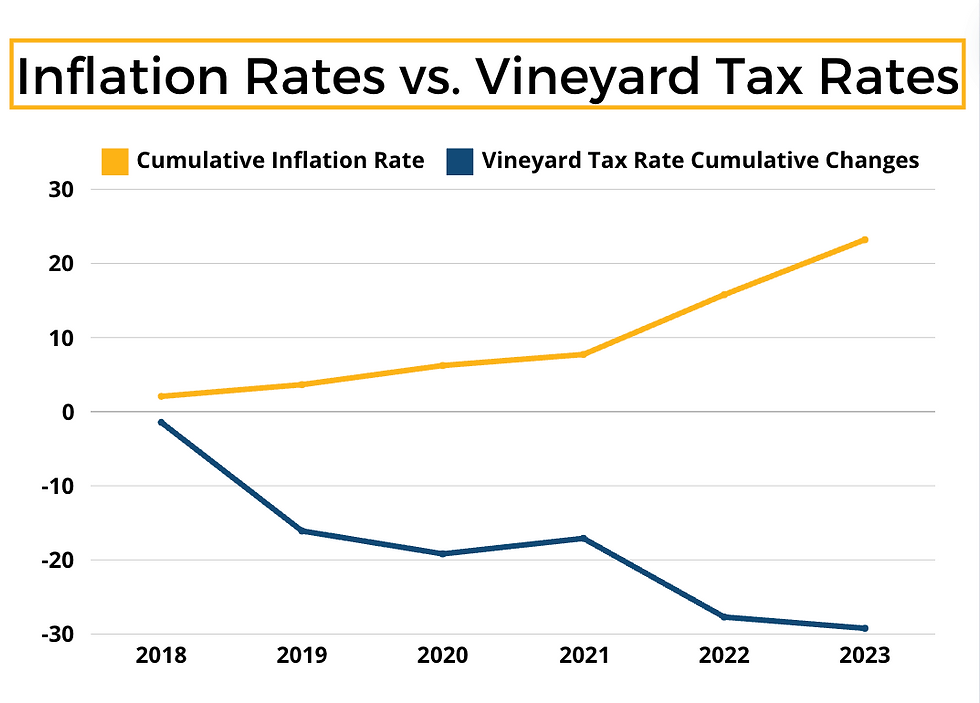

The discussion of a tax rate adjustment arises from steady increases in property values and inflation, which have affected per capita buying power. Between 2017 and 2023, Vineyard’s tax rate decreased by 32.30%, while inflation rose by 22.2%, reducing buying power.

During this period, fire services costs increased by 51.81%, highlighting a critical need for enhanced funding to meet current demands.

Unified Fire Inflation Numbers

Vineyard is committed to being conservative with taxpayer dollars and thoughtful about any changes. Despite this tax rate adjustment, the new rate will still represent a 13% reduction from the 2017 tax rate.

The Utah Taxpayers Association has advocated for lower taxes and sound tax policy in Utah since 1922. Senator Howard Stephenson, former Executive Director of the Association, emphasized the importance of exceeding the certified tax rate through the "Truth-in-Taxation" process to recoup inflationary losses; which ensures adequate funding for essential services.

Vineyard, along with 66 other taxing entities in Utah, will hold public hearings over the next six weeks to discuss proposed property tax adjustments. Out of the 5 local municipalities proposing raising rates, Vineyard is the only entity that has not raised rates in the last 5 years. Vineyard residents are encouraged to attend the hearing on August 14th at 6 PM to provide input or support for the proposed changes.

Truth-in-taxation hearing dates

Utah County: Aug. 15 at 6 p.m. at the Utah County Administration Building in Provo.

Central Utah Water Conservancy District: Aug. 27 at 6 p.m. at the CUWCD HQ in Orem.

Alpine School District: Aug. 13 at 6 p.m.Alpine School District board room in American Fork

Lehi: Aug. 20 at 6 p.m. at Lehi City Hall.

Payson: Aug. 7 at 6 p.m. at the Payson Administration Building.

Provo: Aug. 12 at 6 p.m. at the Provo City Hall.

Springville: Aug. 20 at 7 p.m. at the Springville City Center.

Vineyard: Aug. 14 at 6 p.m. at the Vineyard City offices.

The Vineyard open house discussion, prior to the public hearing, will also include total property tax costs, and shifting tax burden required in state law to help clarify increases experienced, despite Vineyard’s rate decreasing for the last 7 years. <Learn more>

Budgeting Process

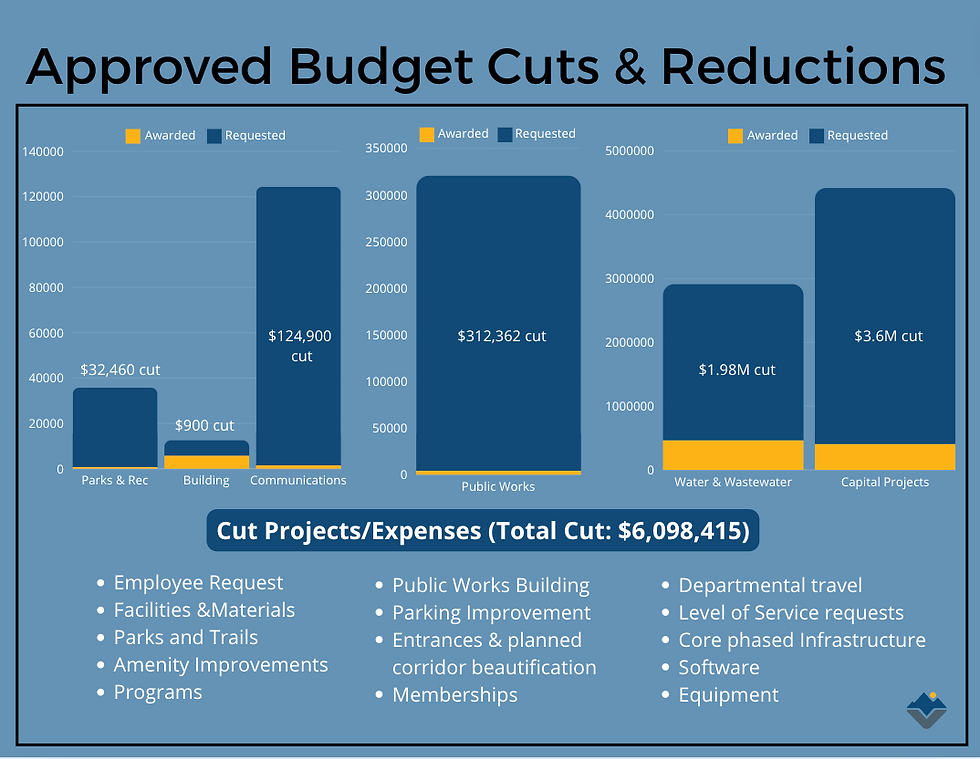

Vineyard goes through a yearly budgeting process with fiscal experts, city departments, and elected officials to review its programs and budgets to reduce waste and enhance its programs, which permits a strong, healthy economy and sensible balance with rational control of government expenditures.

Timeline:

February 20th - Council Retreat

April 10th - Budget Priority Retreat

May 8th – Presentation and approval of Tentative Budget

May 22nd – Public Hearing for Tentative

May-June - Finalize Budget

June 26 – Adopt Final Budget FY25

In this last budget cycle Vineyard followed its budget process approving cuts and reductions of requests that equalled over 6 million dollars, covering things like: employee requests, facilities, materials needs, membership dues, equipment, programs and software, departmental travel budget, level of service requests, amenity enhancements and phased infrastructure.

This budget approach for the last seven years has kept revenues extracted from residents consistently lower than 2017 numbers. The proposed adjustment would only account for 71% of public safety, when last year property tax covered closer to 83%, and without the rate adjustment will be around 59%.

Utah State Law (Section 10-6-116) limits the maximum amount of unrestricted general fund balance local governments can carry to 35%, (was 25% prior to FY 2020-2021) of total actual revenues of the general fund for the year.

The City transfers excess revenue to the Capital Projects Fund in order to meet its pay-as-you-go capital improvement demands. These funds are available as needed to transfer back into the General Fund. Prior to 2016, the City was a Town which designation allowed them to retain 75% general fund revenues.

Many local entities have adjusted their rates over time to keep up with inflation. Because Vineyard has not done so in over 20 years, the percentage sounds large. The reality is that our property tax rate has actually fallen by 32.55%

Support and Relief

Tax Relief Programs: Residents on fixed incomes or those experiencing tax rate discrepancies can find information about state tax relief programs [here].

Utah’s Property Tax System

Utah’s property tax system is governed by a set of laws and regulations commonly referred to as “Truth in Taxation”. The objective of these rules is to keep property taxes from rising simply as a result of increasing property values. Each year the Utah State Tax Commission determines each taxing entity’s “Certified Tax Rate”. Anytime a taxing entity assesses a property tax rate higher than the certified rate, the entity must advertise that rate as a tax increase

The basic calculation takes the entity’s previous year’s tax revenue and divides it by the current year’s assessed value for those same properties. Increases in property tax values will lower the certified rate, while decreases in values will increase the certified rate.

Thus, the taxing entity would receive the same tax revenue as the previous year. The only new revenue to be received is from improvements to properties, referred to as new growth.

The table below give a simple, fictitious example to demonstrate how this process works. The attached full document goes into greater detail with additional examples on how Utah’s property tax system works.

For this example, let’s assume in 2020 the taxable value of property in the City of Vineyard is $7 billion and the current tax rate is .0015.

Truth in Taxation | Taxable Property Value | Tax Rate | Tax Collections |

2020 – All Property | $7,000,000,000 | 0.0015 | $10,500,000 |

2021 – Existing | $7,700,000,000 | 0.001364 | $10,500,000 |

2021- New Property | 200,000,000 | 0.001364 | $272,727 |

2021– Total (New Base) | $7,900,000,000 | 0.001364 | $10,772,727 |

As shown in the fictional example table of the total property tax collections for Vineyard in 2020 is $10,500,000. If existing property values increase 10% from 2020 to 2021, the certified tax rate would decrease from .001500 to .001364 to offset for the increase in value. The result is Vineyard would receive the same revenue, from existing properties, in 2021 as it did in 2020

Continuing the example, if an additional $200 million in property improvements is constructed within the City during 2020 by March 31st, that new construction (growth) will be taxed at the certified rate; 0.001364

So, the tax collections for the new growth total $272,727 and the City would collect a total of $10,772,727 for 2021. Afterwards, a new base is established, and the process will repeat itself the following year.

Tax on individual properties could increase or decrease based on their relative assessment from Utah County.

**If your property increases at a rate higher than the average rate in the City, your taxes would increase: shifting tax burden

**If your property increases at a rate lower than the city average, your taxes would decrease.

shifting tax burden

If you are interested in learning more about Utah’s property laws, you are encouraged to read the full document below.

Utah Property Tax Laws

Laws regarding the taxation of property vary from state to state. Many states have implemented laws and regulations to provide property owners relief from rapidly rising property values.

Utah has its own unique protocols to protect property owners. Title 59, chapter 2, part 9 of the Utah Code contains these laws, which are commonly referred to as “Truth in Taxation” laws.

While the calculations can get complicated, the overall objective is relatively simple. Each year the State calculates, for every taxing entity, a property tax rate known as a “certified” tax rate. This rate is intended to provide the same revenue for existing properties as the taxing entity received during the previous fiscal year.

Additional revenue is allowed for new properties (growth) in the taxing entities’ boundaries. However, no new revenue should be realized as a result of growth in property valuation.

Any additional revenue above the certified rate is considered a tax increase and needs to follow truth in taxation laws.

This document is intended to provide a brief explanation of how these truth in taxation laws impact individual taxpayers as well as the purpose for which Vineyard is considering an increase to the certified rate.

Property Tax Calculation

Each year, the county assessor for each respective property assigns a market value. This can be based on an actual physical assessment, or a statistical analysis based on a variety of factors such as comparable sales and economic data. Once a market value is determined, taxes are assessed differently for a primary residence than for all other properties. Primary residences are taxed at 55% of market value while other properties are taxed at 100% of market value. The taxable value is then multiplied by the entities tax rate to determine the taxes levied to each individual property.

For example, Vineyard property tax rate adj. for fiscal year 2024-2025 is .003369. If you own a home in Vineyard with a market value of $559,000, you will pay $164.18 increase in taxes from the year before. The calculation would include the primary home 55% reduction. .

Continuing the example. If the value of all properties in Vineyard increased 10% over the year, the certified rate would reduce to compensate for the increase in valuation. A 10% increase in property values would reduce the certified rate from .003369 to .003032. Assuming your property also increased in value by 10%, then your new calculation for property taxes would be $559,000 55% = $307,450 .003032- the .003369 tax rate cost, decreasing costs by $105.77. Thus, the amount of taxes you pay would not increase from the previous year to the current year.

Fiscal Period: Year 1

Property Valuation: $559,000

Primary Home Reduction: $307,450

Vineyard Tax Rate: .003369

Vineyard Taxes: $164.18 increase in taxes

Fiscal Period: Year 2

Property Valuation$559,000

Primary Home Reduction: $307,450

Vineyard Tax Rate .003032

Vineyard Taxes: $105.77 decrease in taxes

This calculation is relatively straightforward. However, certain factors can complicate this scenario. Some of these are explained below.

Relative Property Value

shifting tax burden

The example above assumes the increase in value of your property mirrors the increase of all properties within the city.

In practice, this is unlikely to be the case. While the value of all property within the City may have increased 10%, the value of your individual property could have increased more or less than 10%.

If your property increased more than 10%, your taxes would go up. If your property increased less than 10% your taxes would go down.

The chart below shows an example of a property increasing 15% in value as well a property increasing 5% in value based on the same data as the previous example:

Property Value Increase: 15%

Property Valuation: $642,850

Primary Home Reduction: $353,567.5

Vineyard Tax Rate: .003369

Vineyard Taxes: $319.56 increase in taxes

Property Value Increase: (showcasing a 10% increase)

Property Valuation: $559,000

Primary Home Reduction: $307,450

Vineyard Tax Rate: .003369

Vineyard Taxes: $164.18 increase in taxes

Property Value Increase: 5%

Property Valuation: $528,255

Primary Home Reduction: $290,540.25

Vineyard Tax Rate: .003369

Vineyard Taxes: $107.22 increase in taxes

So, whether your tax levy goes up or down depends not on your specific valuation but rather on whether your property value increased faster or slower than the entire city.

Multiple Taxing Entities

The example we’ve been using only assumes one taxing entity, which is Vineyard.

However, your home in Vineyard is subject to tax levies by multiple other entities.

These additional entities include: Utah County, Utah County Assessing and Collecting, Statewide School Basic Levy, Alpine School District, State Charter School- Alpine, Central Utah Water Conservancy, and State assessing and collecting.

our actual tax levy for your property is determined not only by the tax levy assessed by each of these taxing entities, but also by the relative value of your property to other properties within each taxing district. The taxing districts could encompass all of Alpine School District, or all of Utah County.

No Inflation Component

Utah’s property tax laws have no allowance for inflation in the certified tax rate calculation.

New revenue for taxing entities is allowed for the construction of new improvements, but not for inflation.

It needs to be emphasized that the construction of new improvements in the city can lead to increases in expenditures for roads, police and fire services, and parks. More residents and more businesses bring in additional revenue, but can also incur additional costs.

Vineyard's planned downtown development aims to attract businesses that generate less demand for municipal services while creating business tax revenue, easing the tax burden on the residents. This coordinated effort is designed to foster balanced growth and meet the evolving needs of our community.

The intent of the law is for taxing entities to periodically evaluate their tax rate to get current with prevailing costs. If a taxing entity has not adjusted property taxes in 10 years, that entity is paying today’s prices with dollars from 10 years ago.

Even the Utah Taxpayers Association, who has significant influence on the State’s property tax laws has said that periodically, “you do need to look at re-capturing inflation in your property tax revenue.”

Property Tax Outlook

Often taxing entities do everything possible to avoid going through the truth-in-taxation process to raise property taxes.

In 2019 Utah County went through the truth-in-taxation process for the first time in 33 years. Prolonging a tax increase for such an extended period generally will result in a very significant increase. In Utah County’s case, the proposed tax increase was 100%, or double the existing tax rate. Prior to proposing a tax rate increase, the County had operated at a deficit for multiple years and even considered selling off County-owned properties to fund operations. Operating a budget in this manner is neither conservative nor prudent. Reserves are established for emergency situations.

An entity is less able to respond to economic or physical emergencies if reserves are depleted rather than raising taxes to keep pace with inflation.

Vineyard is proposing a return to the 2019 certified property tax number. Vineyard did a comprehensive fire study with ArcGIS engineering data to show response times and 25 year build out. Our fire Chief reviewed our ERU, and recommended new fire standards based on response. This increase the amount of Fire and EMS staff needed in Vineyard to meet national service standards for safe response times. Additionally, the tax rate in Vineyard fell again, creating a reduction in fire and police coverage by 20%. Inflation has continued to rise while the certified rate has fallen. Doing this now will prevent a larger increase in the future and give time for business tax to grow, while maintaining the needed services for our community.

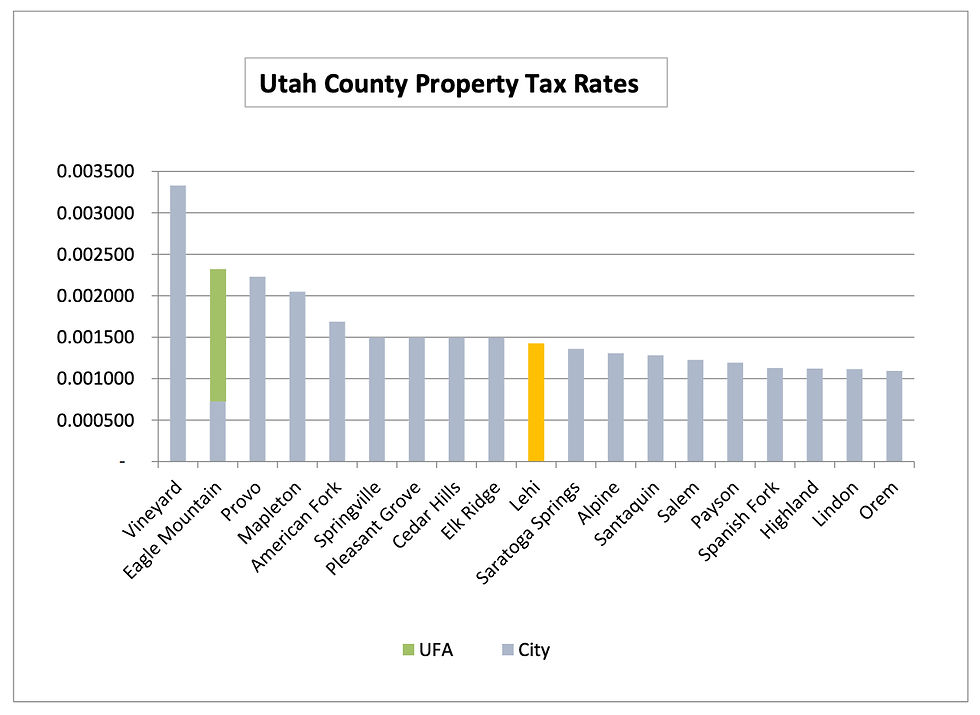

Comparative Property Tax Rates

You can see Vineyard is on the higher end of the property tax rates in the county. Eagle mountain is highlighted to show the taxes included from United Fire. Another consideration is the city’s property tax base relative to cities in the Southern part of Salt Lake County. Vineyards fire provider is competition for employees with these cities. Particularly in relation to public safety employees. Salt Lake County cities typically pay higher property tax rates than Utah County cities.

Vineyards actual city services expenditures from property tax are comparably lower than other cities of similar size, which brings to bare the discussion of the Redevelopment Agency.

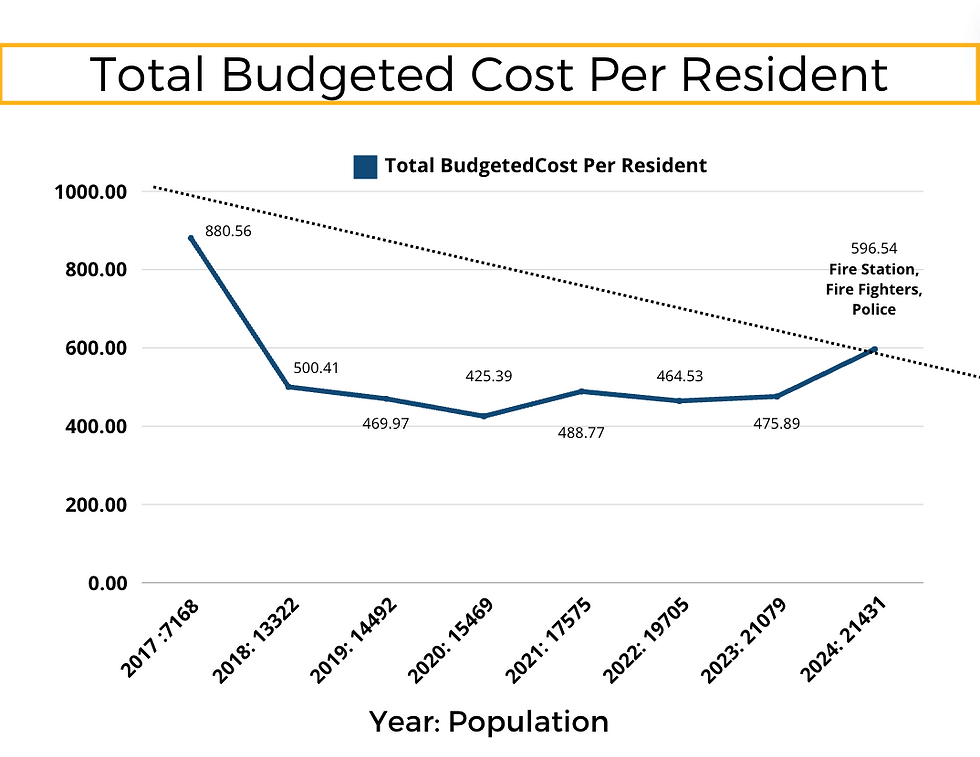

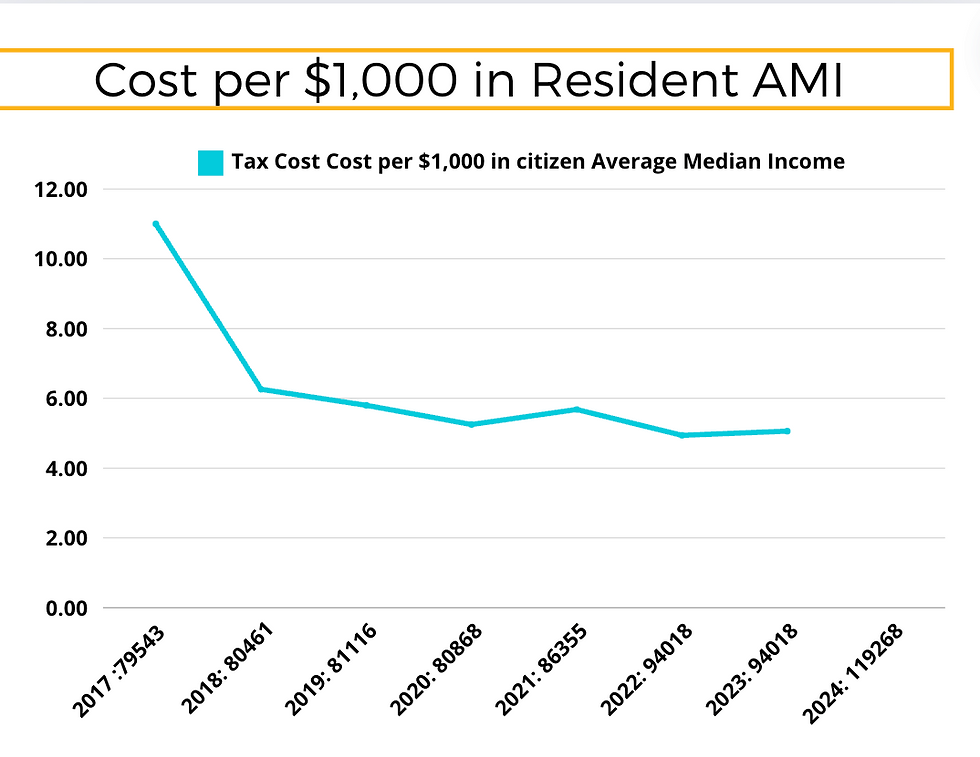

In simple Terms: 75% of taxes go to the RDA with the city capturing 25% making the extracted cost per resident 596.54 closer to the center this year, and on the lower end on avg.

Vineyard's annual extracted tax per resident has decreased since 2017, with injections of infrastructure investment along the way; i.e. land purchase in 2019, Fire Station in 2023-24, or Fire Fighters, EMS and two additional officers in 2024-2025. The proposed increase will take the certified rate back to 2019 numbers.

RDA Project Area Designation

When demolition of the steel mill facilities began, significant environmental remediation for various impacted materials including the coal tar pits was necessitated. The significant blight of relic structures from the mill and environmental containment, as well the complete lack of public infrastructure for future development, reduced the taxable value of the land and created an impediment to re-development. Community reinvestment (RDA) through tax increment financing (TIF) is ideal for this site. The “project area” was created in 2010; 75% of Vineyard proper.

Historical Timeline - Key Dates

1888 - Geneva Resort built (near Lindon boat harbor)

1941 - Construction begins on steel plant (US Steel operates 1943-1987)

1989 - Vineyard incorporated

2001 - Geneva plant closes

2005 - Anderson Geneva acquired the plant site, demolition begins 2005 -

2010 - Creation of the Geneva Project Area (Urban Renewal Plan)

2014 - UVU land acquisition for West campus

2020 - Corrective Action Management Unit (CAMU) completed (large containment of pollutants like coal tar)

2010 Geneva Urban Renewal Area Project Plan (attachment)

2010 Project Plan:

1. Redevelop contaminated/blighted industrial site (over 2,055 acres)

2. Enhance future property & sales tax revenues

3. Create jobs with wide range of skills

4. Attract national tenants and job creators in the Mountain West

5. Alternative transportation hubs to minimize congestion, improve air quality

6. Provide variety of housing types for wide range of income levels

7. Encourage additional development adjacent to the project area 8. Create a sustainable community

Goals & Vision from 2010 Project Plan:

● Work with Utah DEQ, redevelop Brownfield site

● Create a more pedestrian and transit-oriented city

● Transform lake front

● Create intermodal hub transit area & offer transportation corridors

● Tax increment for infrastructure of the master redevelopment plan

Tax Increment Financing - Base Value vs “Increment”

The Base year of tax revenue is 2006 provided to taxing entities. Taxable value of the project area = $120M base value

The value above this base value is called the increment. Taxable value increases after redevelopment and growth

RDA Status: 2023 $1.5Bn current value of project area ($1,534,879,728), 16% increase year over year. The RDA receives tax revenue from 75% of the incremental value above the base.

Increment revenues are used to reimburse infrastructure development costs.

The Taxing entities (Vineyard, Utah County, Utah County Assessing and Collecting, Statewide School Basic Levy, Alpine School District, State Charter School- Alpine, Central Utah Water Conservancy, and State assessing and collecting) still receive 100% of the tax revenue from the base plus 25% of the increment.

There are 5 phases (areas) which each last 25 years. Post Project area, the taxing entities receive the base and 100% of the increment.

Vineyard Redevelopment Agency is building the Assessed Values through clean up, infrastructure and economic development.

Other cities have redevelopment Projects. Geneva is the largest brownfield RDA in the area.

For 60 years, the Geneva steel plant was a significant economic driver for Utah County. It employed 4,200 workers during WWII and around 1,200 workers each year it was in operation.

It yielded $400M in taxable property value.

In its wake, Vineyard stands to continue as an economic hub for the next generation of industries including technology, education and healthcare.

The planned redevelopment will provide 3-4 times the jobs and property tax values as the plant.

Loss in Purchasing Power

For illustration purposes, the chart below shows the loss in purchasing power from inflation. Just looking at the seven years from 2017 – 2023, the blue bar represents actual property tax revenues. The green bar represents what property tax Vineyard would have received if the certified rate was adjusted for inflation.

Vineyard has not implemented a property tax increase for at least 20 years. Certainly, this increase does not compensate for 20 years of inflation. Vineyard has been fortunate to have high residential and new commercial growth which has offset the continual decrease in property tax revenues.

Economic Strategy

Vineyard invested in economic development opportunities that we believed is igniting corporate recruitment.

We have already seen it with Top Golf and Huntsman Cancer Institute, and see broadening of the business tax in return. The city’s multi-year economic strategy is attracting corporate investment and fostering balanced growth.

Partnerships with entities like EdcUtah, World Trade Center Utah, and the Utah Valley Chamber and others are driving economic development and reducing the tax burden on residents.

Moreover, the planned downtown development aims to attract businesses that generate less demand for municipal services while creating business tax revenue

Conclusion

Understanding the law supporting property tax levies is helpful to understand one of the primary funding sources for general city services.

The proposal to make an adjustment to Vineyards property tax rate is not an effort to tax Vineyard residents to excess, but rather an attempt to recapture a portion of purchasing power lost to inflation to provide public safety.

Periodic adjustments to the city’s tax rate will help Vineyard recoup inflation to maintain safety and remain competitive with other cities in attracting and retaining employees. Small and more frequent adjustments to the certified rate will help to avoid large, severe future increases while maintaining a strong financial founda

tion and wise tax policy.

Comments